As we step into 2025, the digital payments landscape in the European Union is poised for transformative changes. Driven by technological advancements and shifting consumer expectations, the way we transact is evolving rapidly. This blog post explores the top digital payment trends in the EU for 2025, delving into what consumers desire and how businesses can adapt to meet these needs.

1. Increased Adoption of Contactless Payments

The Surge in Popularity

The popularity of contactless payments has skyrocketed, particularly in the wake of the COVID-19 pandemic, which prompted consumers to seek safer and more convenient transaction methods. According to recent studies, over 70% of EU consumers have adopted contactless payments, citing ease of use and speed as primary factors. In 2024, this trend is expected to continue, with advancements in technology and an increasing number of businesses adopting contactless solutions.

Consumer Expectations

Consumers now expect seamless and efficient payment experiences. They prefer the convenience of tapping their cards or mobile devices to complete transactions, reducing wait times at checkout. Retailers are investing in upgrading their payment systems to accommodate this demand, ensuring that customers can make quick, hassle-free purchases.

Future Developments

Looking ahead, we can expect innovations in contactless technology, such as biometric authentication methods integrated into payment systems. This could further enhance security while maintaining the speed and convenience that consumers desire. As the infrastructure improves, more retailers will embrace contactless payments, leading to broader acceptance across various sectors.

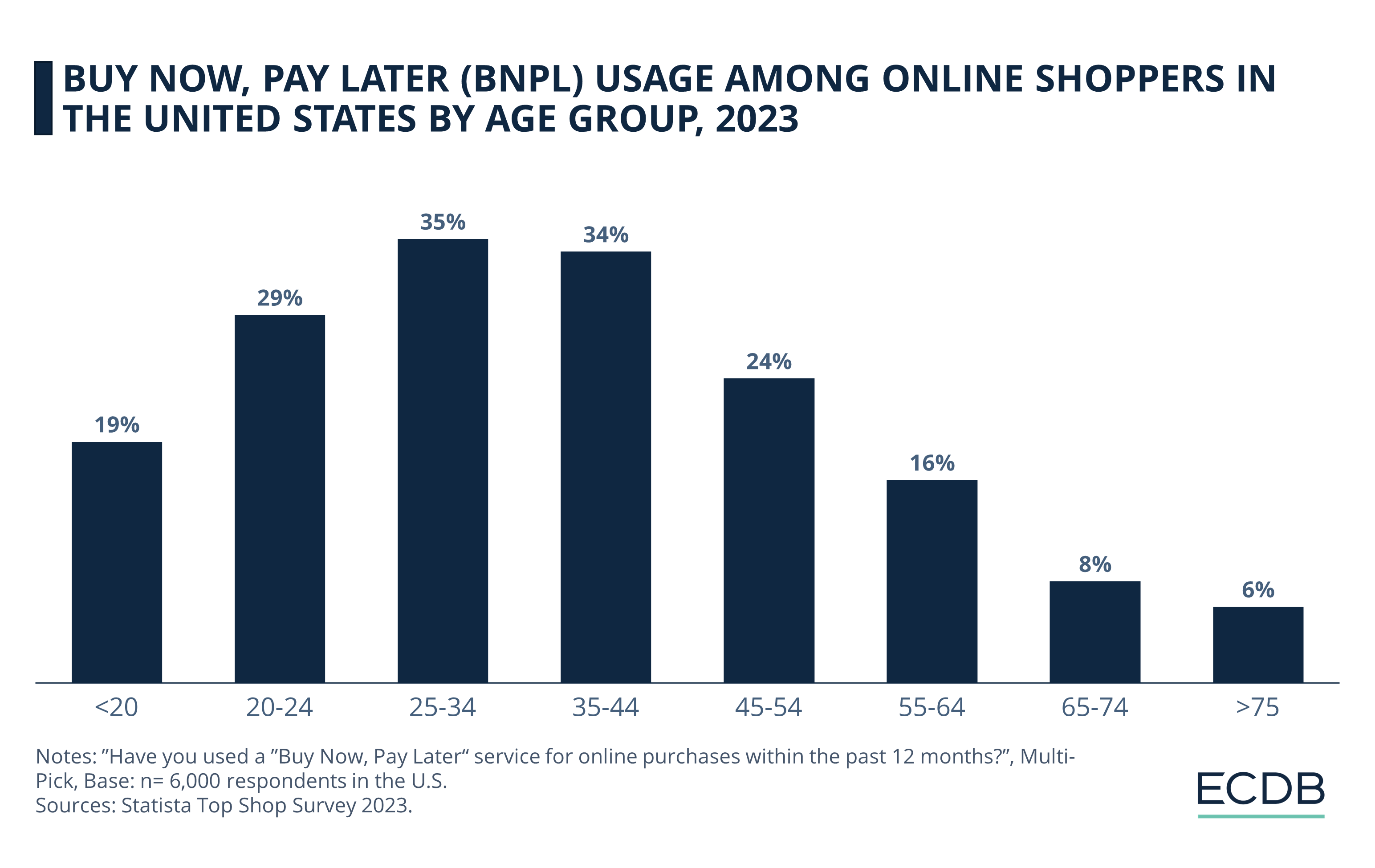

2. Rise of Buy Now, Pay Later (BNPL)

Popularity Among Younger Consumers

The Buy Now, Pay Later (BNPL) model has captured the attention of consumers, particularly millennials and Gen Z. This payment option allows shoppers to purchase items and pay for them in installments, often without interest if payments are made on time. In 2024, the BNPL market is expected to expand significantly, driven by consumer demand for flexibility in their purchasing decisions.

Benefits for Retailers and Consumers

For retailers, offering BNPL can lead to increased sales and higher average order values. Consumers appreciate the ability to manage their budgets better, making larger purchases more accessible. Studies indicate that BNPL options can boost conversion rates, particularly in e-commerce, where customers may hesitate to complete a purchase due to financial constraints.

Regulatory Considerations

However, as the popularity of BNPL grows, so do concerns about consumer debt. In response, regulators in the EU are likely to introduce guidelines to ensure responsible lending practices. Companies that offer BNPL services will need to prioritize transparency and consumer education to maintain trust and comply with evolving regulations.

3. Emphasis on Security and Privacy

Growing Concerns

As digital payments become more prevalent, so do concerns about security and data privacy. Consumers are increasingly aware of the risks associated with online transactions, making security a top priority in 2024. Studies show that nearly 60% of consumers would abandon a payment platform if they felt their data was at risk.

Innovative Security Solutions

To address these concerns, payment providers are investing in advanced security measures. Biometric authentication, such as fingerprint and facial recognition, is gaining traction, offering consumers a higher level of security. Additionally, encryption technologies are being enhanced to protect sensitive information during transactions.

Building Consumer Trust

Transparency is key to building consumer trust in digital payment systems. Companies that communicate their data protection practices clearly and demonstrate a commitment to safeguarding consumer information will likely see increased loyalty and usage of their platforms.

4. Integration of Cryptocurrencies

The Growing Acceptance of Crypto

While still considered a niche market, cryptocurrencies are slowly making their way into mainstream payment options. In 2024, we expect to see an increase in the number of businesses accepting cryptocurrencies as a form of payment. This trend is fueled by a growing segment of consumers who prefer the decentralization and potential anonymity that cryptocurrencies offer.

Regulatory Developments

As interest in cryptocurrencies rises, regulatory frameworks are being established to provide clarity. The EU is working towards comprehensive regulations that address concerns related to consumer protection and fraud. These developments will be crucial in determining how cryptocurrencies integrate into the broader digital payment ecosystem.

Consumer Education and Adoption

For widespread adoption, consumer education is essential. As cryptocurrency becomes more accessible, businesses must inform consumers about the benefits and risks associated with using digital currencies for transactions. Companies that provide resources and support for crypto transactions will likely attract a tech-savvy customer base.

5. Digital Wallets and Super Apps

The Shift Towards Comprehensive Solutions

Digital wallets are evolving beyond simple payment tools. In 2024, consumers are expected to favor comprehensive solutions that combine payment processing, banking, shopping, and social features into one platform—often referred to as “super apps.” This trend reflects a desire for convenience and efficiency in managing various aspects of daily life.

Enhanced User Experience

Super apps streamline the user experience, allowing consumers to perform multiple tasks without switching between different applications. By integrating payment solutions with loyalty programs, budgeting tools, and personalized shopping experiences, these apps can cater to diverse consumer needs.

Competition and Innovation

As competition in the digital wallet space intensifies, companies will need to innovate continually to differentiate themselves. Features such as AI-driven recommendations and enhanced user interfaces will become vital in attracting and retaining users in a crowded market.

6. Personalized Payment Experiences

The Role of Data Analytics

In 2024, personalized payment experiences will become a critical factor in consumer satisfaction. Businesses will leverage data analytics and artificial intelligence to understand consumer behavior better, enabling them to offer tailored payment options, promotions, and loyalty rewards.

Enhancing Customer Relationships

Personalization fosters stronger relationships between consumers and businesses. When payment providers offer customized experiences—such as targeted offers based on spending patterns or reminders for upcoming bills—consumers are more likely to engage with the brand and remain loyal.

Balancing Personalization and Privacy

However, personalization must be balanced with privacy concerns. Consumers are wary of how their data is used, and businesses must prioritize transparency in data collection and usage. Those that respect consumer privacy while offering personalized experiences will build trust and loyalty.

7. Sustainability in Payments

The Rise of Eco-Conscious Consumers

As environmental awareness grows, consumers are increasingly considering sustainability in their purchasing decisions. In 2024, this trend is expected to extend to digital payments, with consumers favoring providers that demonstrate eco-friendly practices.

Green Payment Solutions

Businesses that prioritize sustainability—such as using renewable energy in their operations or offering paperless transaction options—will resonate with eco-conscious consumers. Some payment providers are already implementing initiatives to offset their carbon footprint, and this practice is likely to become more prevalent in the coming years.

Marketing Sustainability

Communicating sustainability efforts effectively will be crucial for attracting and retaining customers. Companies that can articulate their commitment to environmental responsibility will likely see increased brand loyalty and positive consumer sentiment.

8. Regulatory Changes and Compliance

Navigating the Regulatory Landscape

The EU’s regulatory framework surrounding digital payments is continually evolving. In 2024, businesses must stay informed about changes related to the Payment Services Directive (PSD2), the General Data Protection Regulation (GDPR), and upcoming cryptocurrency regulations. Compliance will be essential not only for avoiding penalties but also for building consumer trust.

Impact on Consumer Expectations

As regulations become stricter, consumers will expect higher standards of transparency, security, and fairness in payment practices. Companies that prioritize compliance and demonstrate their commitment to ethical practices will stand out in a crowded marketplace.

Future of Payments

The regulatory landscape will also shape the future of digital payments in the EU. As the market matures, we can expect increased competition among payment providers, leading to innovations and better services for consumers.

Conclusion

As we move through 2024, the digital payments landscape in the EU is set to undergo significant transformations. Understanding these trends is essential for businesses looking to meet consumer demands and navigate a rapidly changing environment. By embracing innovations such as contactless payments, BNPL options, enhanced security measures, and personalized experiences, companies can position themselves for success.

Moreover, a focus on sustainability and compliance with regulatory changes will be crucial in building trust and loyalty among consumers. As the digital payment ecosystem evolves, those who prioritize consumer needs and adapt to emerging trends will thrive in the dynamic landscape of digital finance.